Pin-Up Сasino has been operating in India since 2016. Players from India, Turkey, Russia, Kazakhstan, Azerbaijan, and other countries of the world can access slot machines on the website. Sports betting (football, futsal, hockey, volleyball, basketball, swimming, and other sports) is available in the betting section of the website.

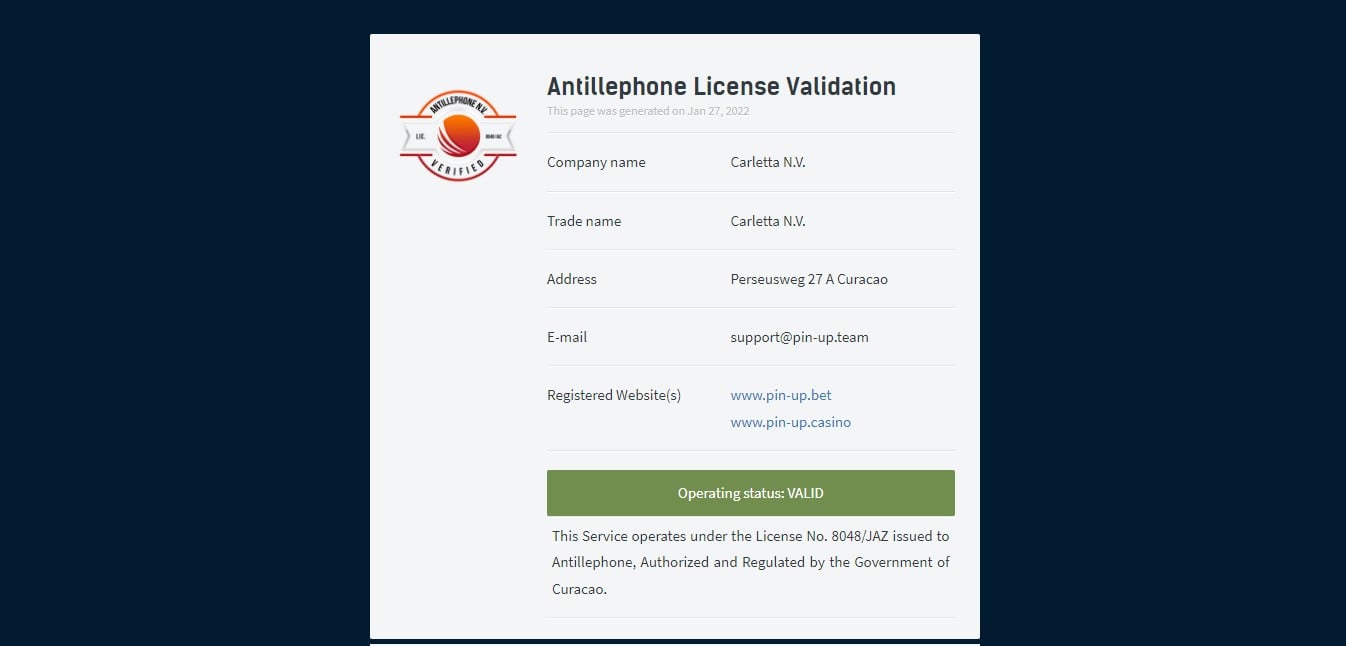

Pin-Up casino is operated by Carletta Limited, a company based in Cyprus. The company is officially registered and has a legal address. The online casino Pin-Up in India operates under the license of Curacao Antillephone N.V. a license operator from Curacao.

| Official site of online casino Pin-Up India | |

| ✔️ Official address of the casino | https://www.pin-up.casino/ |

| ✔️ Beginning of work | 2016 |

| 👷 Owner | Carletta N.V. |

| 🌎 Address | Perseus Weg 27A, Curacao |

| 💫 License | Curacao, №8048/JAZ2017-0003 |

| 🌎 Interface languages | English, Russian, Turkish and others |

| 💰 Payment systems | UPI, Phone Pe, Paytm, Astropay, Google Pay, Much Better, cryptocurrency |

| 🎰 slot machine developers | Amatic, Betsoft, Fugaso, NetEnt, Playtech, Quickspin, Tom Horn, Booongo and others |

| 💰 Minimum deposit to play | 100 rupees |

| 💰 Minimum withdrawal | From 100 to 500 rupees |

| 💬 Support | Online chat, Telegram, e-mail, phone |

| 🎁 Bonus Offers | Welcome bonus, free spins, cashback, birthday present |

| 🤑 VIP Loyalty Program | 9 player statuses with bonuses |

| 🎰 Slot machines | Slots, table games, lotteries |

| 🎰 Live dealers | Blackjack, poker, roulette, show programs |

| 🎰 Sports betting | 40 disciplines, esports |

PinUp Casino in India: